Medical Benefits

Ingenovis Health offers three medical plan options through Anthem.

Before you enroll in medical coverage, take some time to fully understand how each plan works. Scroll down for an overview of the plan benefits.

Ask yourself these questions

Can you set aside money from your paycheck to save for out-of-pocket health care costs?

Consider the Standard HDHP plan. You will have the option to fund a health savings account (HSA) that can save you money on your health care costs. See page 12 for details.

Do you prefer to pay less when you visit the doctor's office?

Consider the Anthem Choice PPO. While you will pay more from your paycheck each month for coverage, you will only be responsible for a small copay or cost share when you need care.

Are you open to receiving care from in-network doctors and healthcare provider ONLY?

Do you live or travel mostly within the 60+ major US cities in the BlueHPN network? Take the blueHPNquiz.Anthem.com to see if the Base Narrow HPN plan may be a fit for you.

Medical Plan Costs

Listed below are the monthly costs for medical insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis, which means you don’t pay taxes on the amount you pay for coverage. Please note that we use 48 pay periods for benefit deductions.

Level of Coverage | Anthem Base Narrow HPN | Anthem Standard HDHP | Anthem Choice PPO |

|---|---|---|---|

Employee only | $102 | $309 | $692 |

Employee + Spouse | $810 | $960 | $1,379 |

Employee + Child(ren) | $733 | $869 | $1,248 |

Employee + Family | $1,157 | $1,371 | $1,970 |

Medical Plan Summaries

• The Anthem Base Narrow HPN offers in-network coverage only through a smaller network of curated providers dedicated to improving patient experience while managing costs. There is no out-of-network coverage; however, you will have urgent and emergency care coverage wherever you go.

• The Anthem Standard HDHP and Anthem Choice PPO plans offer in-and-out-of-network benefits, providing you the freedom to choose any provider. However, you will pay less out of your pocket when you choose an Anthem provider.

The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

Are you covering your spouse and/or children?

If you elect employee + spouse, employee + child(ren), or family coverage, the individual deductible and out-of-pocket maximum apply to each covered member of the family (capped at family amount).

Summary of Covered Benefits | Anthem Base Narrow HPN In Network Only | Anthem Standard HDHP In Network | Anthem Choice PPO In Network |

|---|---|---|---|

Plan Year Deductible Individual/Family | $6,000 / $12,000 | $3,500 / $7,000 | $1,500 / $3,000 |

Out-of-Pocket Maximum Individual/Family | $8,700 / $17,400 Includes deductible, copays, and coinsurance | $5,000 / $10,000 Includes deductible, copays, and coinsurance | $5,000 / $10,000 Includes deductible, copays, and coinsurance |

Preventive Care | Plan pays 100% | Plan pays 100% | Plan pays 100% |

Physician Services Primary Care Physician | $30 copay | 20% after ded. | $30 copay |

Physician Services Specialist | $90 copay | 20% after ded. | $90 copay |

Physician Services Urgent Care | $90 copay | 20% after ded. | $90 copay |

Lab/X-Ray Diagnostic Lab/X-Ray | 30% after ded. | 20% after ded. | 20% after ded. |

Lab/X-Ray High-Tech Services (MRI, CT, PET) | 30% after ded. | 20% after ded. | 20% after ded. |

Hospital Services Inpatient | 30% after ded. | 20% after ded. | 20% after ded. |

Hospital Services Outpatient | 30% after ded. | 20% after ded. | 20% after ded. |

Emergency Room | 30% after ded. | 20% after ded. | 20% after ded. |

Prescription Drugs Tier 1 | $10 copay | Ded., then $10 copay | $10 copay |

Prescription Drugs Tier 2 | $40 copay | $35 copay | $40 copay |

Prescription Drugs Tier 3 | $70 copay | $60 copay | $70 copay |

Prescription Drugs Tier 4 | 25% up to $300 | 25% up to $200 | 25% up to $300 |

Prescription Drugs Mail Order (Up to a 90-day supply | 2.5x retail copay | 2.5x retail copay | 2.5x retail copay |

Anthem Network Options

If you enroll in the Base Narrow plan, you will be utilizing Anthem’s Blue High Performance Network Non-Tiered. If you enroll in the Standard HDHP or the Choice PPO plan, you will utilize Anthem’s broad network. The broad network that you will utilize depends on the state you live in:

State | Network |

|---|---|

DC/Maryland/Northern Virginia | BlueChoice Adv Open Access |

Florida | NetworkBlue |

Georgia | Blue Open Access POS |

Missouri (St. Louis) | Blue Access Choice |

Missouri (Kansas City) | Preferred-Care Blue |

New Hampshire | BlueChoice Open Access POS |

New Jersey | Horizon Managed Care Network |

Wisconsin | Blue Preferred POS |

All other states | National PPO (Blue Card PPO) |

To locate an in-network provider, visit anthem.com/find-care, choose “Select a Plan” for basic search, and enter the following information:

What type of care are you searching for?

Select “Medical Plan” or “Network” from the drop-down list.

What state do you want to search?

Select your home state.

How do you get health insurance?

Select “Medical (Employer-Sponsored).”

Select a plan/network:

Choose the correct network from the list above.

Questions? Call Anthem’s pre-enrollment line at 833-401-1573 for help locating an in-network provider.

Anthem Blue High Performance Network Non-Tiered

Base Narrow plan networks utilize, Anthem’s Blue High Performance Network Non-Tiered (BlueHPN). Answers to frequently asked questions about the BlueHPN are listed below.

What is the Blue High Performance Network?

The BlueHPN is a network of doctors and hospitals who are committed to providing you with consistent high- quality care while keeping your costs down. The BlueHPN is available in more than 60 service areas across the country, including the 10 largest cities in the United States.

I have family members covered under my plan who don’t live in one of the areas served by the BlueHPN.

Outside the areas where the BlueHPN is offered, coverage is limited to urgent and emergency care only. For covered services, your family members will need to receive their care from a BlueHPN doctor.

What will happen if I go to a doctor outside the network?

If you see a doctor outside the BlueHPN for routine or non-urgent care, you will be responsible for the full cost. If you are traveling to an area not served by the BlueHPN, you will only have urgent and emergency care coverage. Use Anthem’s Find Care tool to see if your doctor, specialist, or hospital is in the network before receiving care.

Will the BlueHPN affect my pharmacy benefits?

The BlueHPN has no effect on your pharmacy benefits. You will have access to the pharmacy network selected by your employer.

Preventive Care

Preventive care helps keep you healthier long-term

An annual preventive exam can help IDENTIFY FUTURE HEALTH RISKS and treat issues early when care is more manageable and potentially more effective.

Preventive care helps keep your costs low

With a preventive care exam each year, you can TARGET HEALTH ISSUES EARLY when they are less expensive to treat. You can also effectively manage chronic conditions for better long-term health.

Preventive care keeps your health up to date

Yearly check-ins with your doctor keep your health on track with AGE- AND GENDER-SPECIFIC EXAMS, VACCINATIONS, AND SCREENINGS that could save your life.

Mental Health Resources

Virtual care

You have access to virtual care through Anthem. Get the care you need when and wherever you need it. Whether you're on the go, at home, or at the office, care comes to you in the form of virtual care.

SYDNEY HEALTH APP

The Sydney Health mobile app is the one place to keep track of your health and your benefits. With a few taps, you can quickly access your plan details, member services, virtual care, and wellness resources.

Use the app anytime to:

Find care and compare costs.

See what’s covered and check claims.

View and use digital ID cards.

Chat with an Anthem representative.

Request a virtual care visit with a doctor 24/7.

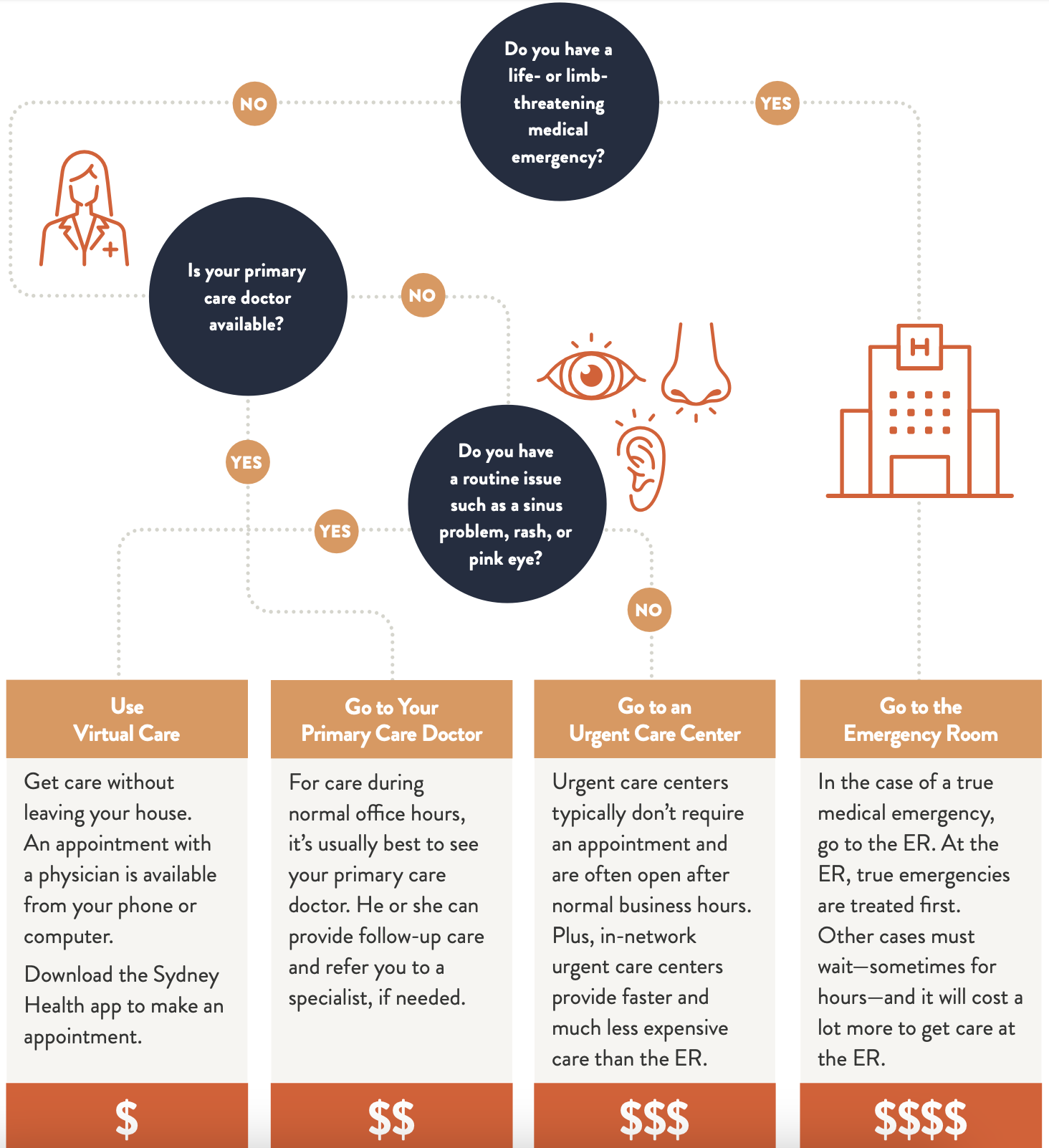

Know Where To Go For Care

Where you go for medical services can make a big difference in how much you pay and how long you wait to see a health care provider. Use the chart below to help you choose where to go for care.